AMD’s stock took a significant hit in after-hours trading, dropping nearly 9% as the company’s latest earnings report revealed weaker-than-expected data-center sales. While the semiconductor giant exceeded Wall Street’s expectations for overall revenue and earnings, its data-center segment failed to meet ambitious analyst forecasts, raising concerns about its competitiveness in the AI-driven market.

Mixed Results: Beating Estimates but Missing Key Targets

Despite the market’s reaction, AMD’s first-quarter performance was far from disappointing. The company posted revenues of $7.1 billion, surpassing the anticipated $7 billion mark. However, the key data-center segment, which includes AMD’s high-performance EPYC CPUs and AI-focused Instinct GPUs, recorded $3.86 billion in sales—an impressive 69% year-over-year increase. Yet, this figure fell short of Wall Street’s expectations of $4.14 billion, sparking investor concern.

The AI semiconductor space is fiercely competitive, with Nvidia maintaining a dominant position. Meanwhile, legacy chipmakers like AMD and Intel are striving to carve out a larger share of this high-growth market. Intel recently admitted that its AI chip offerings had failed to gain significant traction, even scrapping a planned AI chip. AMD, however, has a much stronger foothold, with major industry players incorporating its technology into their AI infrastructures.

AI Partnerships and Expanding Market Reach

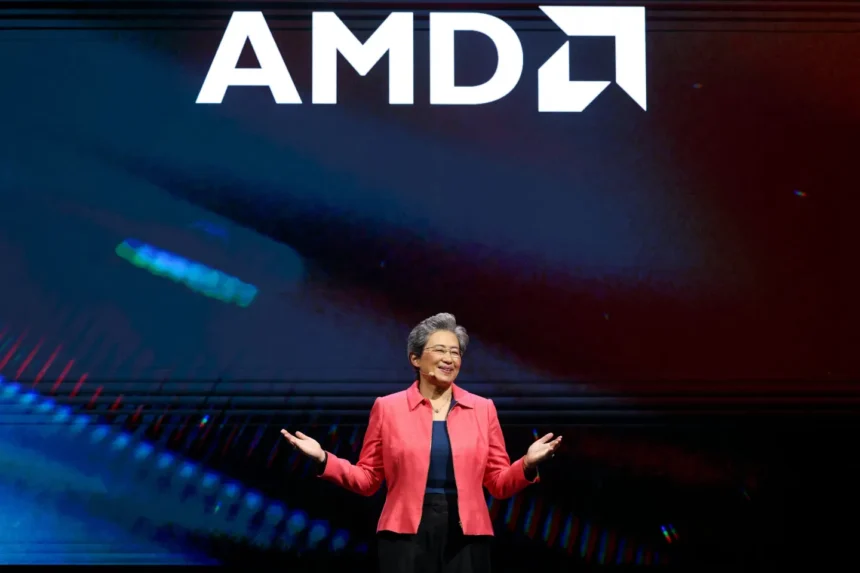

During an earnings call, AMD CEO Lisa Su highlighted the company’s growing influence in AI computing. Major tech giants are leveraging AMD’s MI300X AI chips to power next-generation services:

- Meta has integrated MI300X into its AI operations, including its Llama model within the Meta AI ecosystem.

- Microsoft is utilizing AMD’s AI chips to enhance OpenAI-based Copilot services and other critical workloads.

- IBM and Dell are either actively offering or planning to provide AI services powered by the MI300X platform.

These partnerships signal confidence in AMD’s AI capabilities, but the company still faces an uphill battle against Nvidia’s dominance, particularly due to software challenges. Nvidia’s CUDA ecosystem remains a major advantage, making it easier for developers to optimize their models on its hardware.

AMD is actively working to close this gap through enhancements to its open-source ROCm software platform. Su emphasized its growing adoption, stating, “Our strategy is to establish AMD ROCm as the industry’s leading open software stack for AI, providing developers with greater choice and accelerating the pace of industry innovation.” According to AMD, over 1 million AI models on Hugging Face now run natively on its platform, signaling increasing traction among developers.

Wall Street’s Reaction: Skepticism Amid Optimism

Despite these positive developments, Wall Street remains cautious. On Wednesday, BofA Securities lowered its price target for AMD from $155 to $135 while maintaining a neutral rating. Other financial institutions, including Goldman Sachs and KeyBank Capital Markets, have also recently revised their targets downward, citing concerns over AMD’s ability to compete effectively in the AI and accelerated computing space.

However, analysts remain divided. Some firms, like KeyBanc, have expressed optimism about AMD’s future AI chip roadmap, believing it could drive a turnaround in the company’s fortunes.

The Road Ahead: Next-Gen AI Chips and Competitive Outlook

One of the most critical factors in AMD’s AI ambitions will be the success of its upcoming MI350 series, featuring the new CDNA 4 architecture. Unlike previous iterations that primarily focused on training AI models, CDNA 4 is designed for inference—delivering AI-powered services, an area with massive commercial potential.

Lisa Su projected confidence in this next-generation architecture, stating that CDNA 4 would “deliver the biggest generational leap in AI performance in our history, with a 35x increase in AI compute performance compared to CDNA 3.” She also noted that customer demand had exceeded initial projections, leading AMD to accelerate production shipments from late 2025 to mid-year.

Beyond the MI350, AMD has an even more ambitious roadmap, with plans to launch the MI400 series in 2026. If AMD can execute on these advancements while strengthening its software ecosystem, it could pose a more formidable challenge to Nvidia in the AI space.

Conclusion: A Temporary Setback or a Deeper Issue?

AMD’s latest earnings report presents a nuanced picture: while its AI chip business is gaining traction, the company still faces significant hurdles in meeting market expectations and closing the gap with Nvidia. The accelerated timeline for its next-gen AI chips and growing industry partnerships suggest long-term potential, but investor skepticism persists.

Whether this stock dip is a temporary market reaction or an indicator of deeper concerns about AMD’s AI competitiveness remains to be seen. With the AI revolution in full swing, the coming quarters will be crucial in determining whether AMD can capitalize on this generational shift or remain a challenger in Nvidia’s shadow.