The company didn’t discuss reported cooling issues, but says Blackwell is in full production.

Nvidia’s meteoric rise to the top of the tech industry has solidified its position as the world’s most valuable company, surpassing Microsoft and Apple along the way. With its latest Q3 2025 earnings, the company has proven that its dominance in AI hardware is not just a passing trend—it’s the foundation of a transformative era in computing.

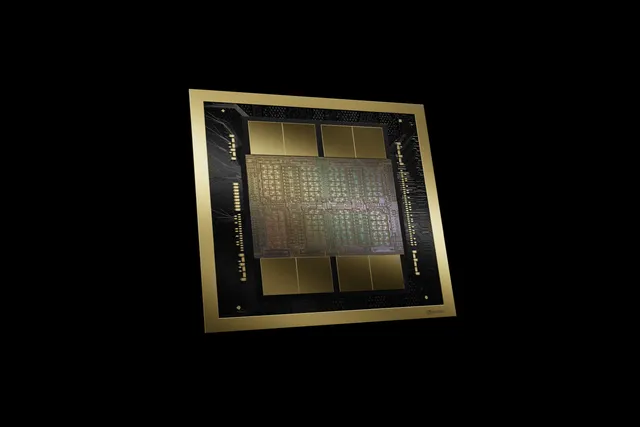

Blackwell Chips: A New Era in AI Computing

In its earnings call, Nvidia exuded confidence in the future of its AI technology, particularly its next-generation Blackwell AI chips. The company assured investors that Blackwell is in “full production” and “full steam” ahead, despite recent reports from The Information about potential cooling issues with its flagship servers. Nvidia’s leadership brushed aside concerns, emphasizing the scale and speed at which it is rolling out the chips.

According to CFO Colette Kress, Nvidia shipped 13,000 Blackwell samples this quarter alone, while CEO Jensen Huang underlined the chip’s early success:

“As you can see from all the systems being stood up, Blackwell is in great shape.”

Huang claimed that the financial impact of Blackwell is already measurable in billions of dollars, and the company expects the momentum to grow in the coming quarters.

AI Drives Nvidia’s Record-Breaking Revenue

Nvidia’s shift from a gaming and graphics powerhouse to a leader in AI is nothing short of historic. While its gaming division—once the cornerstone of its business—now generates $2–3 billion per quarter, its AI-driven data centers are raking in $30.7 billion this past quarter alone. This accounts for the lion’s share of Nvidia’s total quarterly revenue of $35 billion.

Even more impressive is the profitability of these AI operations. Nvidia reported a record-breaking $19.3 billion in net profit for Q3, continuing a trend of explosive growth:

- Q1 Profit: $14.8 billion

- Q2 Profit: $16.6 billion

- Q3 Profit: $19.3 billion

For perspective, even industry giants like Microsoft and Apple earned slightly less in the same period, at $24.7 billion and $21.4 billion, respectively.

A Growing Demand for AI Hardware

Nvidia’s AI journey began with the groundbreaking H100 chip, which laid the foundation for its dominance in data centers worldwide. While the newer Blackwell chips represent the pinnacle of Nvidia’s technology, Huang pointed out that demand for H-series chips remains robust.

The H200 chip, announced just last year, is now Nvidia’s fastest-selling product of all time, generating billions in revenue in just one quarter. Businesses are snapping up these chips to power AI workloads, with demand expected to remain strong throughout 2024. Huang predicts that the older H100 series will continue to see significant orders for another year, highlighting the overlapping demand cycles in the AI chip market.

The Race to Accelerate AI Innovation

Nvidia’s competitors are scrambling to keep up. Rival AMD is experiencing a similar strategic shift, pivoting its focus to AI and accelerating development timelines to release new chips every year instead of the traditional two-year cycle.

This compressed timeline means that the AI chip market is more competitive than ever, with companies like AMD looking to chip away at Nvidia’s dominance. However, for now, Nvidia remains firmly in the driver’s seat, with a commanding lead in both performance and market share.

Meanwhile, Intel continues to lag behind in the AI race. The company is undergoing restructuring in an effort to catch up, but it remains far from achieving the scale and profitability that Nvidia and AMD have attained in this space.

What’s Next for Nvidia?

As Nvidia moves into the future, it’s clear that its focus on AI is only beginning to bear fruit. With Blackwell chips rolling out at scale, demand for H-series products holding steady, and a market increasingly hungry for AI-powered solutions, the company has firmly positioned itself as the backbone of the AI revolution.

For Nvidia, the question isn’t whether it can maintain its dominance—it’s how much further it can extend its lead. With the promise of even more advanced chips on the horizon and record profits fueling innovation, Nvidia is on track to define the future of technology.