The construction industry is plagued by a chronic slow payments problem. Studies reveal that it typically takes construction companies two to three months to receive payments. This delay is caused by factors such as project hold-ups, multiple payment layers, and cost overruns. The impact is significant: in 2023, sluggish construction contract payments surged to $273 billion, representing 14% of the year’s total project expenditures.

In 2021, Matthew Calvano, Henry Bradlow, and Francisco Enriquez identified back-office inefficiencies as the root cause of these delays. Together, they co-founded Adaptive, a platform dedicated to streamlining payments and accounting for general construction contractors.

“The construction payment chain is incredibly complex, involving banks, developers, general contractors, and subcontractors,” Calvano explained to TechCrunch. “Most construction companies are small- and medium-sized businesses (SMBs) without financial expertise, contributing to the industry’s slow payments.”

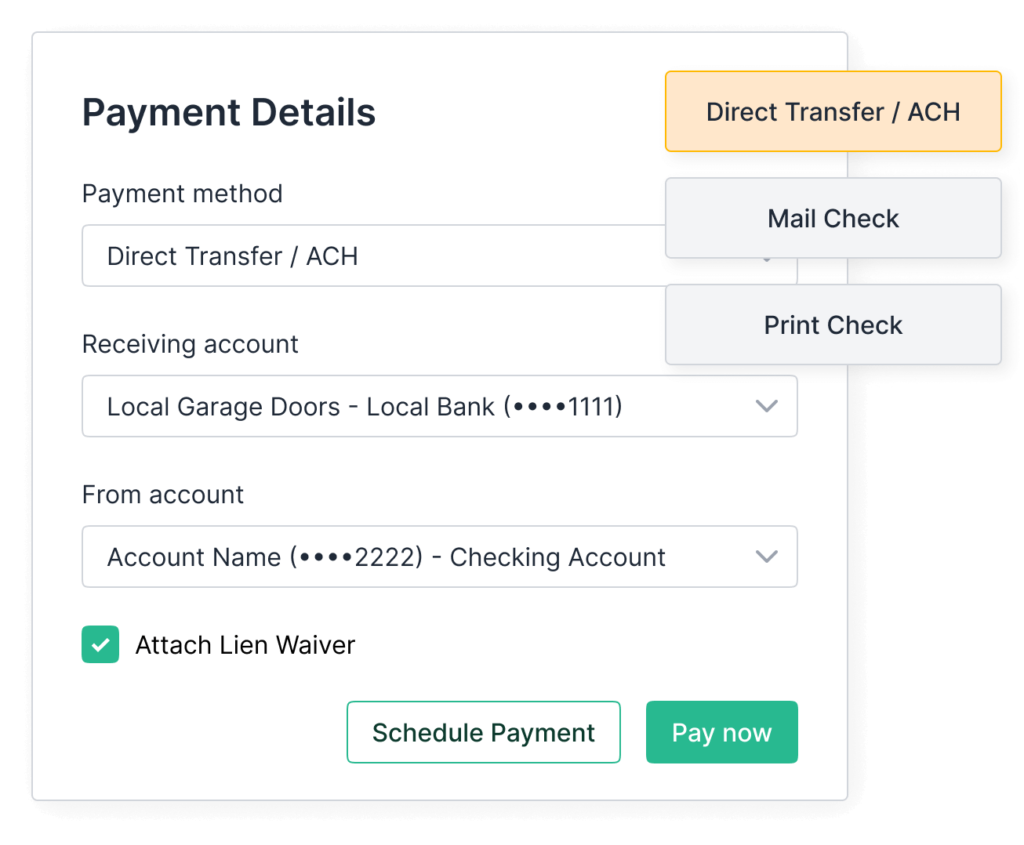

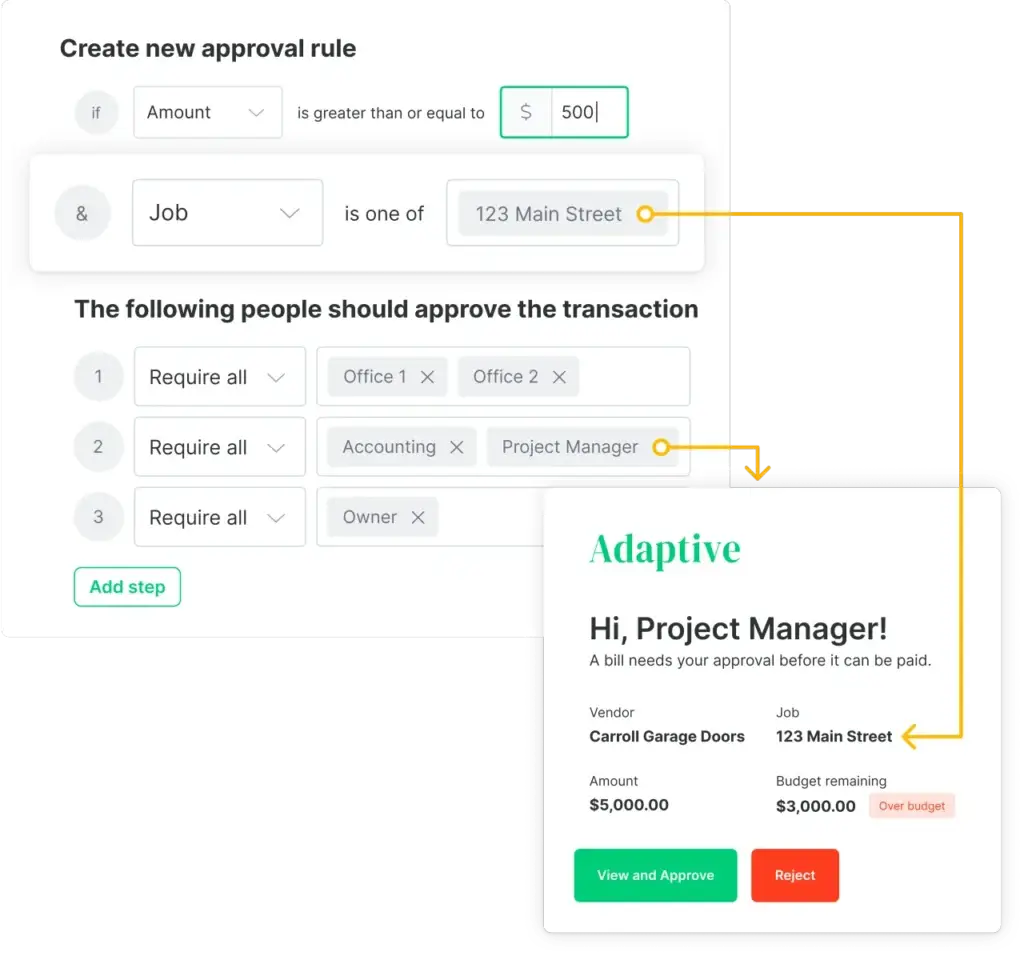

Adaptive recently closed a $19 million Series A round led by Emergence Capital. The platform offers a suite of workflow automations for financial management, including budgeting, expense tracking, accounts payable, and electronic payments. Users can upload documents such as insurance agreements and payment requests in formats like SMS and PDF, and leverage automations to take action, such as approving requests and budgets.

“We’ve developed generative AI algorithms to automate financial management and bookkeeping workflows unique to construction,” said Calvano. “Our main competitor is the manual labor involved in managing financials, typically supported by email, Excel, file sharing, and legacy project management software.”

Adaptive’s competitors include Briq, which offers similar financial workflow automation, Beam, a fintech focused on streamlining payments, invoices, and receipts for contractors, and MakersHub, which deciphers accounts payable data for construction companies.

Despite the competition, Adaptive appears to be thriving, with over 280 construction companies on its client list, ranging from custom homebuilders and commercial general contractors to real estate developers.

Calvano outlined Adaptive’s growth strategy: “In the near term, we’re focusing on acquiring subcontractor clients by developing tailored products for that segment. Medium-term, we plan to explore monetizing integrated payments, insurance, and payroll functions.”

Calvano emphasized the potential for embedded finance: “Managing our customers’ entire financial workflows presents numerous opportunities, especially for SMBs that are often underserved in financial services.”

Adaptive’s Series A round also saw participation from Andreessen Horowitz, Definition, Exponent, 3kvc, Box Group, and Gokul Rajaram, bringing the startup’s total funding to $26.4 million. Part of the proceeds will be used to expand Adaptive’s New York-based workforce from 29 to 45 by year-end, Calvano told TechCrunch.

By crafting a comprehensive suite of automation tools, Adaptive aims to revolutionize financial management in the construction industry, speeding up payments and driving efficiency for contractors and developers alike.