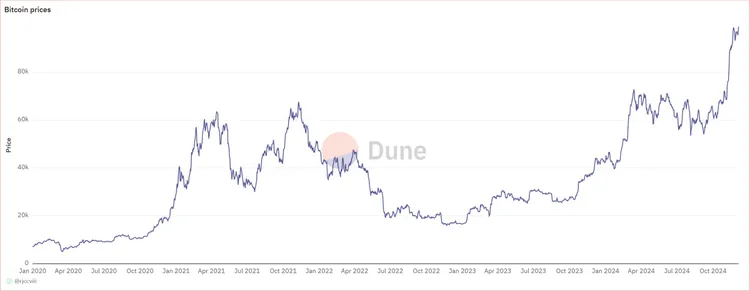

Bitcoin topped the $100k mark after Donald Trump announced a new leader for the SEC under his administration.

In a historic moment for cryptocurrency enthusiasts, Bitcoin has shattered records, soaring past the $100,000 mark. As of this writing, the digital asset is trading at an astonishing $103,359, according to Kraken. This milestone marks Bitcoin’s highest price since its inception over a decade ago, cementing its status as a premier alternative investment and payment option. However, Bitcoin’s value continues to be measured in U.S. dollars, reflecting its role as an asset class rather than a full-fledged replacement for traditional fiat currencies.

Trump’s Victory: The Spark That Ignited Bitcoin’s Rally

Bitcoin’s recent meteoric rise has been closely tied to political developments in the United States. The cryptocurrency hovered around $69,000 on Election Day, but the announcement of Donald Trump’s victory in the 2024 U.S. Presidential Election sent shockwaves through the market. Within hours of the news, Bitcoin surged to $75,000, and the rally gained even more momentum as investors anticipated a more crypto-friendly environment under Trump’s leadership.

Trump, a vocal advocate for blockchain and digital assets, has doubled down on his pro-crypto stance. During his campaign, he launched his own cryptocurrency platform and promised to protect Bitcoin assets held by the federal government. Additionally, he announced his intent to replace Securities and Exchange Commission (SEC) Chair Gary Gensler, who has faced criticism for his stringent regulatory stance on cryptocurrencies. Gensler has since confirmed that he will step down in January 2025.

Pro-Crypto Leadership Takes Shape

The market’s optimism was further bolstered when Trump revealed his nominees for key positions in his administration. Among the most notable picks was former SEC Commissioner Paul Atkins, a long-time advocate for digital innovation, who has been tapped to lead the SEC. Atkins, a co-chair of the Chamber of Digital Commerce’s Token Alliance, has been a vocal supporter of blockchain technology and its potential to revolutionize industries.

In his announcement, Trump emphasized his administration’s commitment to fostering innovation in the digital asset space, declaring that “digital assets and other innovations are crucial to Making America Greater than Ever Before.” This clear signal of regulatory support has fueled investor confidence, pushing Bitcoin’s price past the historic $100,000 threshold.

BlackRock and Institutional Momentum

While Trump’s victory provided the initial spark, other key factors contributed to Bitcoin’s rapid ascent. BlackRock’s much-anticipated Bitcoin Exchange-Traded Fund (ETF) began trading options this week, with an impressive $1.9 billion in trades on its first day alone. The ETF’s strong debut signals growing institutional adoption of Bitcoin, which further legitimizes the cryptocurrency in the eyes of mainstream investors.

Institutional players like BlackRock have long been seen as gatekeepers to broader market acceptance, and their involvement has significantly increased Bitcoin’s appeal to traditional investors. The success of the ETF is likely to pave the way for similar financial products, creating new avenues for investment and liquidity in the cryptocurrency market.

Beyond $100,000: What’s Next for Bitcoin?

Bitcoin’s journey to $100,000 represents a watershed moment, but it also raises questions about the future of digital currencies. As regulatory clarity improves and institutional adoption accelerates, Bitcoin could continue to gain traction as both a store of value and a medium of exchange. However, its continued reliance on fiat currency for valuation underscores the challenges it faces in becoming a true replacement for traditional money.

Additionally, Trump’s crypto-friendly policies could usher in a new era for the blockchain industry in the U.S., potentially attracting innovation and investment from around the globe. The combination of regulatory support, institutional backing, and growing public interest positions Bitcoin for further growth, but it also amplifies the need for responsible governance and market stability.

A Turning Point for Cryptocurrency

The $100,000 milestone is more than just a number—it’s a testament to how far Bitcoin and the broader cryptocurrency ecosystem have come. From its early days as a niche experiment to becoming a global financial force, Bitcoin’s rise is a reflection of shifting attitudes toward decentralized finance.

As we move into 2024 and beyond, the cryptocurrency market will undoubtedly face challenges, but the potential for growth and innovation remains immense. Whether Bitcoin can maintain its upward trajectory depends on a delicate balance of regulatory developments, market dynamics, and technological advancements.

For now, Bitcoin enthusiasts have every reason to celebrate. The journey to $100,000 has been long and unpredictable, but it’s a clear indication that the cryptocurrency revolution is far from over.