A rising tech disruptor, DeepSeek, is shaking up the artificial intelligence (AI) landscape with a groundbreaking cost-effective AI model. Unlike competitors relying on cutting-edge hardware, DeepSeek’s model leverages less advanced chips, posing a significant challenge to Nvidia’s dominance and driving declines in AI-related stocks.

A Game Changer for Global AI Markets

DeepSeek’s innovative model, which rivals offerings from OpenAI and Meta, has garnered significant attention for its transparency and efficiency. The company’s approach emphasizes practicality over expensive, energy-intensive infrastructure, resonating with businesses seeking cost-effective solutions.

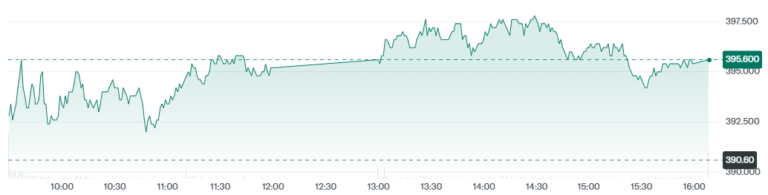

The model’s rapid ascent to the top of the App Store underscores its appeal. However, its success has also prompted a sell-off in AI-related stocks, including Nvidia, as investors begin reevaluating the high valuations of companies central to the AI boom.

Nigel Green, CEO of deVere Group, commented, “DeepSeek is disrupting the global tech landscape and reshaping the direction of the AI arms race. This marks a historic pivot in the balance of technological power, with Silicon Valley’s leadership facing credible competition from China.”

DeepSeek Challenges Assumptions About China’s AI Capabilities

DeepSeek’s success is challenging the long-held belief that China’s AI technology lags behind that of the U.S. By utilizing widely accessible open-source technology and leveraging deep data reservoirs, DeepSeek demonstrates that innovation doesn’t always require cutting-edge hardware.

“DeepSeek threatens to spook big tech,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. “While Nvidia’s latest chips remain far superior, the efficacy of DeepSeek’s budget-friendly model could start to chip away at Nvidia’s dominance.”

DeepSeek’s willingness to share its know-how is another critical factor, enabling broader adoption of AI solutions and fostering competition globally. This approach is poised to erode the pricing power of U.S. tech giants and shift the dynamics of AI innovation.

Ripple Effects Across Asian Markets

The buzz surrounding DeepSeek has fueled optimism in Chinese tech firms such as Tencent, Alibaba, and Baidu. Investors are speculating that collaborations with DeepSeek could boost these companies’ global competitiveness. As a result, Tencent’s shares rose 1.3%, Alibaba gained 3.5%, and Baidu increased by 4.2% on Monday.

“For investors, this is both a warning and an opportunity,” said Nigel Green. “It’s time to rethink traditional tech allocations and explore new areas of growth.”

In contrast, Japanese chipmakers experienced significant losses. Companies like Advantest, Tokyo Electron, and Renesas Electronics, which are closely linked to Nvidia’s supply chain, saw stock prices fall. Advantest dropped 8.6%, Tokyo Electron declined 4.9%, and Renesas Electronics fell by 1.2%. Even Softbank, which owns chip designer Arm, faced an 8.3% decline.

The Implications for Global Tech

DeepSeek’s rise underscores a shift in the global tech landscape, with China accelerating its advancements in AI. The company’s achievements demonstrate that cost-effective AI development can disrupt traditional industry leaders, forcing them to adapt to a rapidly evolving competitive environment.

While Nvidia remains a dominant force with superior technology, the emergence of cheaper, high-performing alternatives will likely spur further innovation and competition. The global AI market now stands at a crossroads, with emerging players like DeepSeek poised to redefine its trajectory.

For investors and industry leaders alike, DeepSeek’s breakthrough serves as a reminder that the next big innovation may not always come from established giants. Instead, it highlights the growing importance of agility, accessibility, and cost-efficiency in shaping the future of AI.