Apple has officially unveiled the iPhone 16e, the latest addition to its lineup, aimed at budget-conscious consumers in emerging markets, including India. Replacing both the iPhone SE and iPhone 14, the 16e is now the most affordable entry into Apple’s flagship lineup. However, its impact on India’s highly competitive smartphone market remains uncertain, as Apple faces stiff competition not just from rival brands but also from its own previous-generation models.

India’s Growing iPhone Market

India, the world’s second-largest smartphone market after China, has been a key driver of Apple’s global sales. In 2024, India became the fourth-largest market for Apple, following the U.S., China, and Japan. Apple saw record-breaking shipments of 12 million iPhones in the country, with an impressive 35% year-over-year (YoY) growth. Analysts expect this number to surpass 15 million in the coming year, further cementing India’s importance in Apple’s strategy.

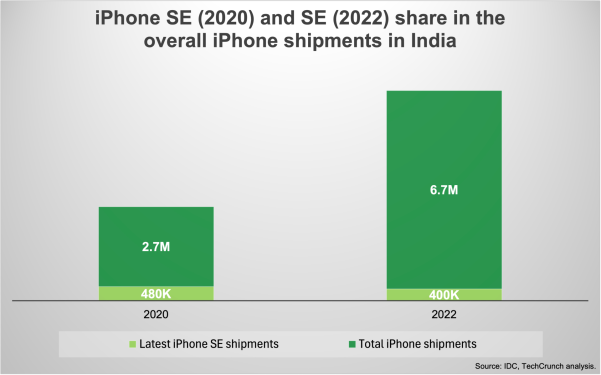

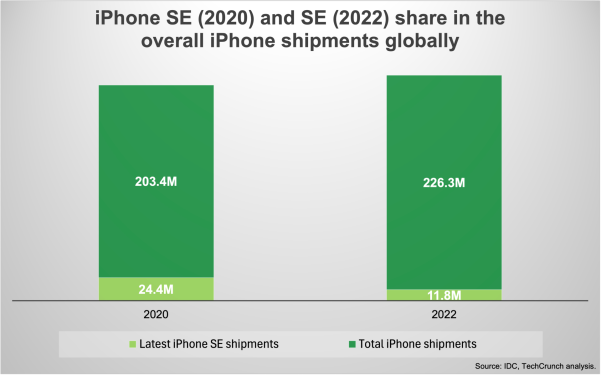

Despite this growth, Apple’s success in India hasn’t been fueled by budget models like the iPhone SE or iPhone 14. Instead, the iPhone 13 and iPhone 15 have dominated sales, collectively holding a 6% share of the overall smartphone market in Q4 2024. The iPhone SE, once a promising budget-friendly alternative, has witnessed a significant decline in popularity over the years. When the iPhone SE (2020) launched, it accounted for 18% of overall iPhone shipments. By the time the SE (2022) was released, its share had dropped to just 6%, and by 2023, shipments of the SE model had dwindled to negligible levels.

The iPhone 16e’s Challenge in India

The iPhone 16e enters a market dominated by Android devices, where the average smartphone price hovers around $259. Brands like Xiaomi, Vivo, and Oppo have built a stronghold in the budget and mid-range segments, offering feature-rich smartphones at competitive prices. However, Apple remains the leader in the premium smartphone market, particularly in the $600+ segment, where its main competitor is Samsung’s Galaxy lineup.

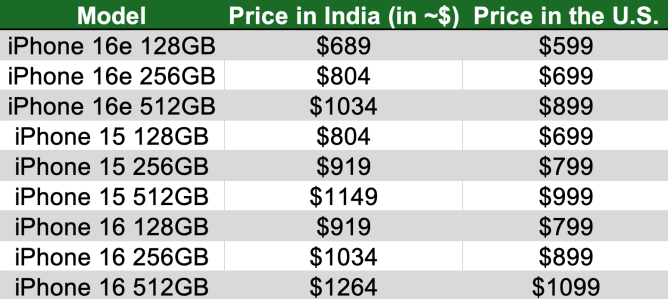

Apple has priced the iPhone 16e at 59,900 Indian rupees (~$689), with the top-tier variant reaching $1,034. While this price point is lower than the iPhone 15 ($804) and the standard iPhone 16 ($919), the difference may not be significant enough to entice buyers, especially given the compromises the iPhone 16e makes in features.

A major factor affecting the 16e’s appeal is the way Indian consumers purchase premium smartphones. Many buyers opt for equated monthly installment (EMI) plans, making higher-priced models more accessible. With EMI options, the price gap between the iPhone 16e and an iPhone 15 or even an iPhone 16 becomes negligible, leading many to opt for the more premium models instead.

One analyst noted, “With EMI offers, the difference in real terms would make many prefer the iPhone 15 or 16 over the iPhone 16e.” This sentiment highlights the challenge Apple faces—convincing consumers to choose the 16e when slightly older but more feature-packed models are available at similar prices.

Apple’s Strategy: Manufacturing and Apple Intelligence

Apple is increasingly investing in local manufacturing, with the iPhone 16e being assembled in India alongside the rest of the iPhone 16 lineup. While this move is expected to help Apple optimize supply chains and avoid heavy import duties, it is unlikely to impact the pricing of the device in the short term.

One of the iPhone 16e’s key selling points is its inclusion of Apple Intelligence—a suite of AI-powered features designed to enhance user experience. However, Apple Intelligence is currently only available in the U.S. and will not roll out in India until April. This delay further reduces the device’s immediate appeal, as Indian buyers won’t be able to take advantage of one of its most significant software upgrades at launch.

Timing and Seasonal Discounts

Another factor working against the iPhone 16e is its release timing. In India, major smartphone purchases often happen during festive seasons, such as Diwali, when consumers expect heavy discounts and attractive offers. Releasing the iPhone 16e outside of this buying cycle may limit its initial traction.

Analysts predict that Apple will introduce discounts for the iPhone 16e during the festive season later in the year, but so will retailers selling older iPhone models. As a result, price cuts on the iPhone 15 and iPhone 16 may make them even more attractive than the newly launched 16e, potentially cannibalizing its sales.

Will the iPhone 16e Attract New Buyers?

The iPhone 16e could appeal to a niche audience—specifically, younger buyers who want a more affordable entry into the iPhone ecosystem. Some analysts believe that the 16e might attract consumers who would have otherwise purchased an iPhone 12 or iPhone 13, both of which are still widely available in the Indian market at discounted rates.

Unlike markets in Latin America and Southeast Asia, where telecom carriers subsidize smartphone prices through bundled plans, India is not a telco-driven market. This means buyers must pay the full cost of the device upfront or rely on EMI plans. Without carrier subsidies, the iPhone 16e may struggle to stand out, especially when compared to more feature-rich older iPhone models that are now available at reduced prices.

Conclusion

The iPhone 16e is Apple’s latest attempt to tap into India’s expanding market with a more affordable offering. However, it faces tough competition from Apple’s own older models, which continue to sell strongly due to aggressive pricing by retailers. While the 16e does bring new features like Apple Intelligence and a locally manufactured design, these may not be enough to sway buyers in the short term.

With EMI plans minimizing the price difference between models and festive discounts expected later in the year, many Indian consumers may still opt for the iPhone 15 or 16 instead. If Apple wants the iPhone 16e to gain traction, it may need to reconsider its pricing strategy or introduce exclusive features to differentiate the model from its predecessors.

For now, Apple’s biggest competitor in India isn’t Android—it’s Apple itself.