India, the world’s second-largest smartphone market after China, boasts around 750 million users. Yet, the average Indian still finds it challenging to afford a brand-new smartphone. This financial hurdle has driven millions of Indian consumers to stick with their existing feature phones or upgrade to a new, yet still basic, feature phone.

Feature Phones: An Unwavering Trend

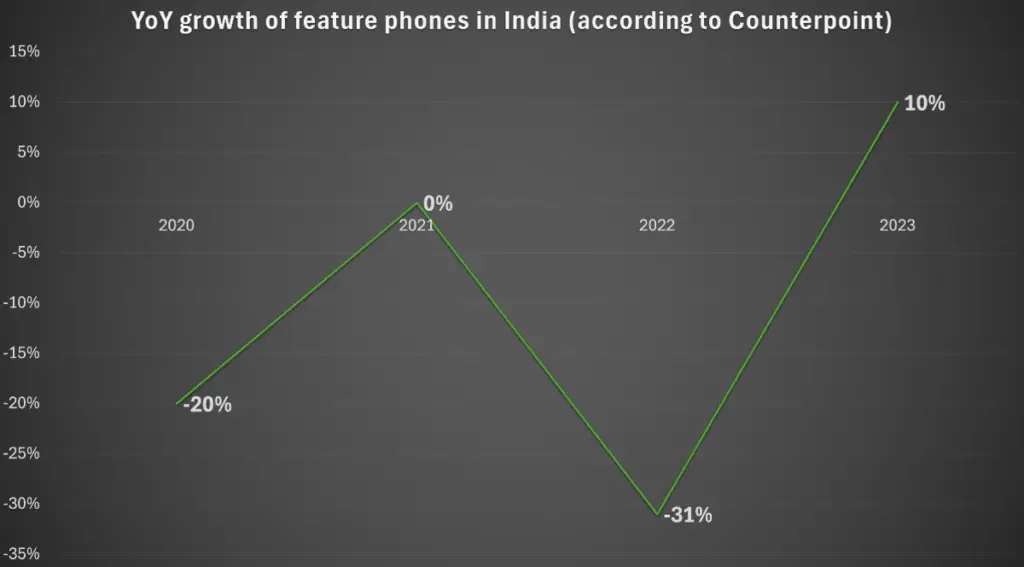

Feature phone shipments in India have surprisingly surged, despite their outdated technology and limited functionalities compared to smartphones. According to market analyst firm Counterpoint, feature phone shipments saw a 10% year-on-year growth last year, rebounding from a -31% decline in 2022. This increase highlights the ongoing resistance of many users to transition to smartphones.

4G feature phone shipments in India notably grew to 25% in 2023, up from 9% in 2022. However, 2G feature phones still dominate with a 75% market share. Indian telecom giant Reliance Jio leads the 4G feature phone market with a 27% share, followed by Transsion Holdings-owned Itel and Indian phone maker Lava, holding 24% and 18%, respectively. Jio’s 4G feature phones, offering basic apps like JioCinema, JioTV, and WhatsApp, have somewhat hindered the shift towards smartphones, as noted by Tarun Pathak, Research Director for Devices and Ecosystems at Counterpoint.

Jio’s Strategic Move: The 5G Feature Phone

In a bid to capitalize on the feature phone trend, Jio is quietly planning to launch a 5G feature phone. Jio, India’s leading telecom player in terms of subscriber base and revenues, has a history of gradually transitioning from feature phones to smartphones. Despite its first smartphone, launched in collaboration with Google in 2021, failing to make a significant impact due to its high price and mediocre specifications, Jio sees feature phones as its key to widespread market penetration.

The upcoming 5G feature phone, running on Linux-based KaiOS, is currently being prototyped by Dixon Technologies and Neolync. While an official announcement is expected at Reliance’s annual general meeting in August, the phone might not hit the mass market immediately. Jio is also in initial talks with Qualcomm for the early version of its 5G feature phone, although other chipmakers might be involved as discussions progress.

In addition to the 5G feature phone, Jio plans to launch a 5G Android tablet and a 5G smartphone this year. The telco aims to expand its telecom revenues and monetize 5G connectivity, with a potential public listing on Indian stock exchanges valued at $112 billion as early as next year.

The Journey So Far: Jio’s Feature Phone Evolution

Jio’s journey with feature phones began in August 2017 with the launch of the JioPhone, a 4G feature phone based on KaiOS. The JioPhone quickly became the top-selling feature phone in India, later adding support for popular apps like Facebook, WhatsApp, and YouTube.

In 2018, Jio introduced the next-generation JioPhone 2 with a QWERTY keyboard. However, its limited availability and appeal prevented it from replicating the success of its predecessor. Last year, Jio launched the Jio Bharat, a $12 feature phone series, and updated the original JioPhone with the JioPhone Prima, boosting the 4G feature phone market in India.

Why Millions of Indians Aren’t Switching to Smartphones

Despite an 11% year-on-year growth in India’s smartphone market in the first quarter, the entry-level segment (sub-$100) saw a 14% decline in market share, dropping from 20% to 15%. Market experts attribute this decline to the reluctance of feature phone users to switch to affordable smartphones.

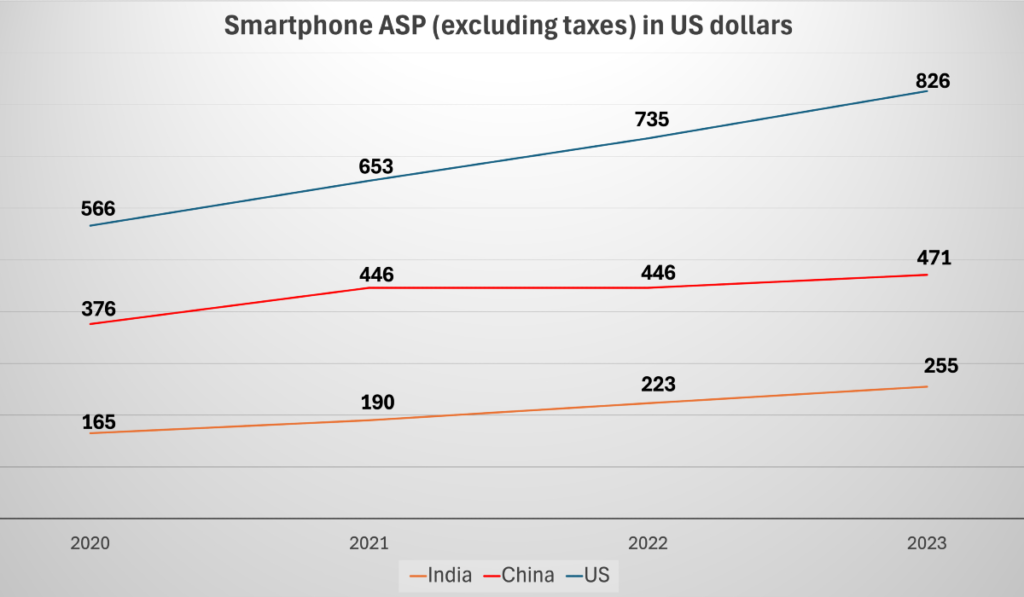

Navkendar Singh, Associate Vice President for Devices Research at IDC, notes that around 350 million people in India still use feature phones, with half of them owning models that cost less than $18. The transition from feature phones to smartphones is challenging, particularly for older individuals and those in low-income groups and blue-collar jobs. The average selling price (ASP) of a smartphone in India has risen to $255, up from $165 in 2020, making it less affordable despite being among the cheapest globally.

While smartphone brands offer financing options, these primarily benefit existing smartphone users looking to upgrade rather than attracting new buyers. The financial constraints and the wide pricing gap between feature phones and smartphones continue to limit the switch to smartphones in India.

By understanding the complexities of the Indian market and the persistent demand for affordable feature phones, brands can better strategize their approach to capture new smartphone buyers and drive growth in this dynamic landscape