India’s digital economy is on the cusp of a seismic shift. At the heart of this transformation lies Unified Payments Interface (UPI), a revolutionary payments network that processes over 13 billion transactions every month. UPI has not only redefined how Indians pay for their daily needs but has also positioned the country as a global leader in digital payments. Yet, this success has ignited a critical debate that could reshape the mobile payments market for over a billion people.

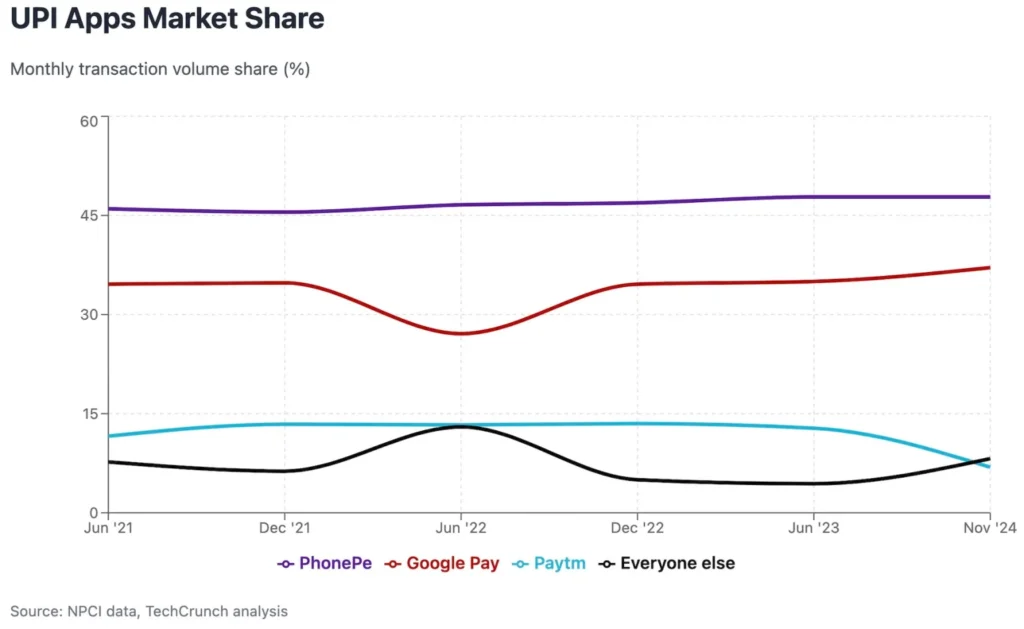

The National Payments Corporation of India (NPCI), which operates under the guidance of the Reserve Bank of India, is poised to make a crucial decision. As early as Monday, the regulator may enforce a rule limiting any single company to handling no more than 30% of UPI transactions. This move directly targets market heavyweights Walmart-owned PhonePe and Google Pay, which currently dominate with market shares of 47.8% and 37.1%, respectively. Such a mandate could alter the competitive landscape, creating opportunities for smaller fintech startups while posing significant challenges for the current leaders.

A Rule in the Making: The 30% Market Cap

The 30% market cap rule, first proposed in 2020, was designed to prevent monopolistic dominance and foster a competitive ecosystem in the mobile payments space. However, implementation has been repeatedly delayed—from its original deadline in January 2021 to 2023, and now 2025—as regulators grapple with the complexities of enforcement.

For PhonePe, valued at $12 billion and backed by Walmart, the uncertainty surrounding this regulation has become a stumbling block on its path to a much-anticipated initial public offering (IPO). Sameer Nigam, PhonePe’s co-founder and CEO, recently voiced his concerns: “If you are buying a share at Rs 100 and you price it assuming we have 48-49% market share, then there is an uncertainty about whether it will come down to 30% and by when.” Speaking at a fintech conference, Nigam urged regulators to clarify their concerns or explore alternative solutions that address market imbalance without undermining existing leaders.

The Stakes for India’s Fintech Ecosystem

The implications of a market cap extend far beyond PhonePe and Google Pay. Smaller fintech startups and emerging players stand to benefit significantly if these giants are forced to limit their transaction volumes or pause onboarding new users. By leveling the playing field, the rule could unlock new growth opportunities for competitors who have struggled to gain traction in a market dominated by two major players.

However, critics argue that such a cap could disrupt the seamless user experience that has made UPI a household name in India. “Enforcing a limitation on the market share will impact the consumer experience,” warned sources close to the matter. With fewer users allowed to onboard onto PhonePe and Google Pay, existing customers could face hurdles in accessing their preferred payment platforms, potentially eroding trust in the system.

Balancing Innovation and Competition

This dilemma underscores the broader challenge of balancing technological innovation with market competition. UPI has been a cornerstone of Prime Minister Narendra Modi’s vision to digitize India’s economy and reduce its reliance on cash. By enabling instant, cost-free bank transfers using simple identifiers like phone numbers, UPI has democratized access to financial services for millions of Indians, particularly those underserved by traditional banking systems.

Global tech giants, including Walmart, Google, and Meta, have invested heavily in India’s digital economy, recognizing its young, tech-savvy population as a critical growth market. Any regulatory intervention, such as enforcing the 30% cap, would mark one of the most significant moves in India’s tech sector and could set a precedent for how the country navigates the tension between innovation and regulation.

Potential Outcomes: Delay or Adaptation?

Insiders suggest that the regulator is leaning toward either delaying the implementation of the cap yet again or raising the limit to over 40%. Such a compromise would address concerns about market dominance while minimizing disruptions to the user experience. The NPCI has held multiple rounds of discussions with stakeholders, and the decision, expected imminently, could have far-reaching implications.

For PhonePe, the stakes couldn’t be higher. The uncertainty has cast a shadow over its IPO plans, which, if successful, would be one of India’s most prominent technology debuts. Meanwhile, Google Pay, with its significant market share, faces similar challenges in navigating a landscape that may soon be redefined by regulation.

A Defining Moment for India’s Digital Economy

As the NPCI deliberates, the world watches. India’s approach to regulating its mobile payments market will serve as a litmus test for how governments can balance fostering innovation with ensuring fair competition. Whether the 30% cap is enforced, delayed, or modified, the outcome will have profound implications for the future of digital payments in India and beyond.

For now, UPI remains a testament to India’s technological prowess, a system that has revolutionized payments and empowered millions. As the nation grapples with its mobile payments dilemma, one thing is clear: the decisions made today will shape the financial landscape of tomorrow.