The global tech scene has been buzzing with the sudden rise of DeepSeek, a low-cost Chinese AI chatbot that has taken the market by storm. In a stunning turn of events, the app has become the most downloaded free app in the US just days after launch. Its cost-efficient model—reportedly built at a fraction of its American counterparts’ budgets—has unsettled investors who now fear a shake-up in the AI landscape.

Meanwhile, US President Donald Trump’s administration continues to champion massive AI infrastructure spending, reflecting America’s determination to keep pace. But with Chinese AI developers closing the technological gap, the question remains: Is the US poised to lose its AI edge?

Below, we break down how DeepSeek’s rise has impacted major tech stocks, what the latest market reactions are, and where the industry might be headed next.

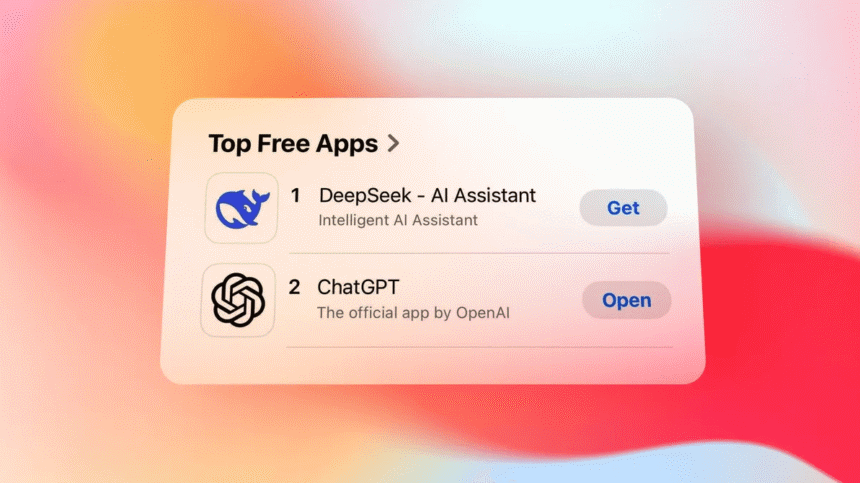

DeepSeek: The Underdog That’s Now on Top

Launched only last week, DeepSeek catapulted itself to the top of US download charts, surpassing even established social media and communication apps. It uses the DeepSeek-V3 model, an AI system trained at a reported cost of around $6 million—pocket change compared to the billions funneled into advanced AI research by American giants like OpenAI and Google.

DeepSeek’s creators credit this cost-efficiency to:

- Open-source software: Code available for free, which can be tweaked and redistributed widely.

- Innovative computing approaches: Models that require significantly fewer high-end chips.

- Smart hardware mix: Pairing stockpiled premium chips with more affordable, widely available components.

The result? A chatbot capable of advanced reasoning, math, coding, and language tasks—at a fraction of its rivals’ costs. Tech investor and Trump adviser Marc Andreessen has labeled DeepSeek “AI’s Sputnik moment,” emphasizing its disruptive potential.

Wall Street Reacts: Turbulent Tech Stocks

Monday’s Sell-Off

DeepSeek’s rapid emergence triggered a wave of sell-offs among US and European tech stocks:

- Nvidia ended Monday down 16.9%

- Broadcom dropped 17.4%

- Microsoft declined 2.14%

- Alphabet (Google’s parent) sank by more than 4%

In Europe, the spillover was equally jarring:

- ASML (Dutch chip equipment maker) lost over 7%

- Siemens Energy plunged by a staggering 20%

Latest Stock Prices (Tuesday’s Update)

As of Tuesday’s close (January 28, 2025):

- Nvidia recovered slightly, ending the day at -1.6% from Monday’s close.

- Broadcom slid further by -2.1%, reflecting ongoing uncertainty.

- Microsoft posted a modest uptick, closing at +1.3%.

- Alphabet stabilized, edging up +0.9%.

- ASML held steady, finishing at around -0.5%.

- Siemens Energy regained some ground, up +3.2% after Monday’s drastic drop.

According to Fiona Cincotta, senior market analyst at City Index:

“We hadn’t factored in a viable, low-cost Chinese AI rival, so this jolt caught many investors off-guard. While some stocks are rebounding, the long-term implications are still murky.”

DeepSeek Under Fire: Cyberattacks and Registration Limits

The skyrocketing user interest has also invited unwanted attention. On Monday, DeepSeek’s creators announced that they are temporarily limiting new registrations due to “large-scale malicious attacks.” Existing users remain unaffected, but the incident underscores how quickly popular AI services can become targets for bad actors.

China’s AI Leap: A Game-Changer?

DeepSeek’s breakthrough arrives as the US enforces tighter export controls on advanced chips to China. Despite these restrictions, Chinese AI firms have showcased remarkable adaptability:

- Stockpiling top-tier chips like Nvidia’s A100 before the ban.

- Pairing high-end chips with more cost-effective alternatives to stretch resources.

- Experimenting with streamlined AI models that require less computing power.

Some experts worry this will challenge the US dominance in AI. Yet, a recent report from Citi bank cautions that China’s AI future isn’t entirely secure, pointing to ongoing chip supply issues and geopolitical headwinds.

“In an inevitably more restrictive environment, US access to advanced chips is still an advantage.”

Meet the Founder: Liang Wenfeng

At the center of this AI storm is Liang Wenfeng, the 40-year-old entrepreneur from Hangzhou, China. Liang, an information and electronic engineering graduate, also founded the hedge fund that bankrolled DeepSeek.

He reportedly built up an inventory of around 50,000 Nvidia A100 chips before stricter export curbs took hold—enough to power his project’s early stages. Liang has since been seen meeting with Chinese Premier Li Qiang, fueling rumors of deeper government support.

In a 2024 interview, Liang expressed surprise at the global focus on DeepSeek’s budget-friendly pricing:

“We didn’t expect pricing to be such a sensitive issue. We simply calculated costs and set our prices accordingly.”

Latest News: U.S. AI Infrastructure Funding

Despite DeepSeek’s rise, American AI firms are not standing still. Last week, OpenAI joined several other companies in pledging $500 billion towards new AI infrastructure in the US—a move President Trump heralded as “the largest AI infrastructure project in history” to keep America’s tech leadership intact.

Industry insiders believe this funding could:

- Bolster domestic chip manufacturing and lessen reliance on global supply chains.

- Accelerate AI research and development in specialized fields such as healthcare, finance, and defense.

- Spur job creation in high-tech sectors across the country.

Still, questions linger about whether massive spending alone can counter the swift rise of cost-effective solutions like DeepSeek.

Looking Ahead

- Corporate Strategies

- We can expect Nvidia and other AI hardware providers to reevaluate their strategies, possibly developing more mid-range chips to stay relevant if low-cost AI solutions gain traction.

- Policy and Regulation

- With China’s AI prowess under the spotlight, White House and Congressional interest in further restricting technology exports or boosting domestic production will likely rise.

- Investor Sentiment

- While some stocks rebounded on Tuesday, overall market sentiment remains cautious. Investors will closely monitor DeepSeek’s next moves—and any new competitors that emerge with similarly low-cost models.

- Cybersecurity Concerns

- DeepSeek’s recent cyberattack underscores the importance of robust security measures for any AI service. As usage skyrockets, so does the threat of hacking and data breaches.

Conclusion

DeepSeek’s rapid success has introduced a new chapter in the AI race—one marked by innovation, cost-efficiency, and high-stakes competition. While US firms continue making colossal bets on AI infrastructure, Chinese developers have shown that big-budget spending isn’t the only path to cutting-edge AI.

Whether DeepSeek’s ascent will permanently tilt the balance of power remains to be seen. For now, it stands as a wake-up call to both investors and policymakers: The AI battlefield is evolving quickly, and those who adapt will shape the technology’s future.

Have thoughts on this development?

Drop a comment below or share this post. Let’s continue the conversation about the changing face of AI—because the race has only just begun.