NVIDIA’s stock suffered its largest single-day decline on Monday, falling 17% after Chinese startup DeepSeek unveiled a cost-effective AI model.

A Shocking Market Movement

NVIDIA’s stock experienced an extraordinary freefall on Monday, January 27, 2025, plunging 17% and wiping out nearly $600 billion in market value. The sudden sell-off left analysts, investors, and tech enthusiasts grappling with the implications of what could be a seismic shift in the artificial intelligence (AI) and semiconductor industries.

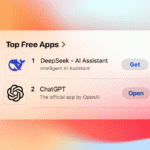

The trigger? A groundbreaking announcement by Chinese AI startup DeepSeek about their revolutionary R1 artificial intelligence model, which has reportedly achieved comparable performance to leading Western models at a fraction of the cost. This development has not only shaken investor confidence in NVIDIA but has also reverberated across the broader semiconductor sector.

Why Did DeepSeek’s Announcement Hit NVIDIA So Hard?

DeepSeek’s R1 model represents a significant leap forward in AI technology, particularly for its cost efficiency. Remarkably, the startup developed the model using NVIDIA’s own GPUs, leveraging stockpiled hardware. The announcement raised pressing questions about the future demand for high-performance AI chips, which form the backbone of NVIDIA’s business model. Investors are now worried about whether NVIDIA can maintain its dominance in a rapidly evolving industry.

Adding to the market jitters, DeepSeek’s achievement highlights the growing competitiveness of Chinese tech firms in the AI space. The prospect of cost-effective, high-performing alternatives threatens to disrupt the balance of power in the semiconductor industry, particularly as global AI adoption accelerates.

Ripple Effects Across the Semiconductor Industry

NVIDIA wasn’t the only company affected by the news. The semiconductor sector as a whole experienced widespread declines as investors reevaluated valuations and growth prospects. Key players such as Advanced Micro Devices (AMD), Marvell, Broadcom, and Taiwan Semiconductor Manufacturing Company (TSMC) all suffered significant losses. The U.S. technology sector collectively dropped by 5.6% on Monday, underscoring the magnitude of the market reaction.

The sell-off reflects growing unease about the competitive pressures facing U.S. semiconductor companies. With Chinese firms demonstrating the ability to deliver high-performing AI solutions at lower costs, traditional chipmakers could face increased scrutiny over their pricing models and value propositions. This may force a shift in how tech companies approach AI infrastructure investments, focusing more on optimizing existing resources rather than committing to constant hardware upgrades.

Overreaction or Justified Concern?

While the market’s reaction was undeniably dramatic, some analysts argue that it might be overblown. For one, increased efficiency and accessibility of AI technologies could expand the overall market, potentially benefiting established players like NVIDIA. This phenomenon, known as the Jevons Paradox, suggests that technological advancements often lead to greater demand rather than reduced consumption.

Additionally, NVIDIA remains a cornerstone of the AI ecosystem. The company is deeply embedded in major U.S. AI infrastructure projects and continues to innovate at the forefront of semiconductor technology. Industry heavyweights, including Microsoft CEO Satya Nadella, have expressed optimism that breakthroughs like DeepSeek’s R1 model could create opportunities for collaboration and growth rather than outright displacement.

Technical Analysis: What’s Next for NVIDIA’s Share Price?

From a technical standpoint, Monday’s plunge marked a critical break in NVIDIA’s one-year uptrend, with the share price falling below the $125.31 support level. Analysts are closely monitoring whether the stock can recover above this threshold by Friday’s weekly close. A recovery would signal that the long-term uptrend remains intact, albeit with a flatter trajectory.

Key levels to watch include:

- Monday’s low at $116.70: If this level holds on a daily closing basis, it could provide a foundation for a rebound.

- 55-day Simple Moving Average (SMA) at $112.46: A break below this level could pave the way for a deeper sell-off.

- Psychological $100 mark: Breaching this level would likely trigger significant bearish momentum, potentially revisiting September’s low of $100.95.

In a bullish scenario, partial closure of the recent price gap between $128.40 and $137.09 could follow, providing some relief for investors. However, the severity of the decline has created a challenging environment for short-term traders and long-term investors alike.

Broader Implications for the Tech Sector

The fallout from DeepSeek’s announcement highlights the growing importance of cost efficiency and innovation in the AI and semiconductor industries. As Chinese tech firms gain ground, Western companies may need to rethink their strategies, focusing on partnerships, software optimization, and diversifying revenue streams.

Moreover, this episode underscores the vulnerability of even the most dominant players in the face of disruptive innovation. Investors should prepare for continued volatility as the market adjusts to these emerging dynamics.

What This Means for Investors

For those invested in NVIDIA or the semiconductor sector, this week’s developments serve as a stark reminder of the importance of risk management and diversification. While NVIDIA’s long-term growth potential remains strong, heightened uncertainty may lead to more turbulence in the short term.

Here are some key takeaways for investors:

- Stay Informed: Thoroughly research the semiconductor sector and AI industry to understand emerging trends and competitive dynamics.

- Diversify Your Portfolio: Avoid overexposure to individual companies or sectors to mitigate the impact of unexpected events.

- Adopt Risk Management Strategies: Use tools like stop-loss orders and trading alerts to protect your investments during periods of heightened volatility.

- Focus on Long-Term Potential: Despite short-term setbacks, the semiconductor industry is poised for substantial growth as AI adoption accelerates globally.

How to Trade NVIDIA Shares

For those looking to trade NVIDIA shares, here are the steps to get started:

- Open an account with a trusted trading platform.

- Research NVIDIA’s market performance and industry position.

- Analyze technical indicators to identify potential entry and exit points.

- Use appropriate risk management tools, such as stop-loss orders.

- Monitor market developments closely, especially updates on AI innovation and geopolitical factors.

Final Thoughts

While NVIDIA’s 17% drop is undeniably alarming, it’s important to maintain perspective. The company’s robust market position and continued relevance in the AI ecosystem provide reasons for cautious optimism. At the same time, the rise of cost-efficient alternatives like DeepSeek’s R1 model signals a new era of competition that could reshape the semiconductor landscape.

For investors, this is a time to stay vigilant, diversify, and focus on the long-term potential of AI and related technologies. The road ahead may be turbulent, but it’s also rife with opportunities for those who are prepared to navigate the shifting tides of innovation.